Initial Capital is a firm, not a fund. This means we have neither limited partners, nor an investment committee taking part in our decision making process. Being focused on early-stage startups, our sweet-spot is the $100K-300K range, however, we do have the flexibility to invest higher amounts.

Beyond an initial investment, Initial will be at the disposal of its portfolio for follow-on investments. We are comfortable co-investing along-side institutional investors, micro-vc's, and angels. At times we will lead a deal, while other times we will follow others.

Apart from straight-up cash, we put our expertise, skills, and contacts to work for our portfolio companies in areas ranging from strategy, business development, product launch, public relations, and hiring.

We are street-smart, sneaker-wearing, laid-back investors. No bankers in fancy offices in tall buildings here. When you do business with us, we become akin to co-founders — an extension of your team.

'We' becomes 'us'. And then it's 'us' versus 'them'. Gladiators in the ring. United we'll stand.

Beyond an initial investment, Initial will be at the disposal of its portfolio for follow-on investments. We are comfortable co-investing along-side institutional investors, micro-vc's, and angels. At times we will lead a deal, while other times we will follow others.

Apart from straight-up cash, we put our expertise, skills, and contacts to work for our portfolio companies in areas ranging from strategy, business development, product launch, public relations, and hiring.

We are street-smart, sneaker-wearing, laid-back investors. No bankers in fancy offices in tall buildings here. When you do business with us, we become akin to co-founders — an extension of your team.

'We' becomes 'us'. And then it's 'us' versus 'them'. Gladiators in the ring. United we'll stand.

ROI CARTHY

ROI CARTHYManaging Partner

Roi is well known in the Israeli startup community as a connector, advisor, and as the Israeli correspondent for TechCrunch. You can find his posts here. His relationship with the Web goes quite a way back. In fact, it goes back to the days before the Web… Email has been in his life for 30 years, and his first chat session was in 1984.

Since becoming a professional in the industry, Roi has advised startups in areas ranging from Investment and Profitability Strategies, to Beta & General Availability Launch Programs, to Product Strategy. Roi has also worked at companies such as Zend Technologies, and most recently at Soluto, as Head of Products.

Roi has an extensive network of contacts, locally in Israel and in the US, ranging from leading technology companies and startup executives, to tier-1 media outlets.

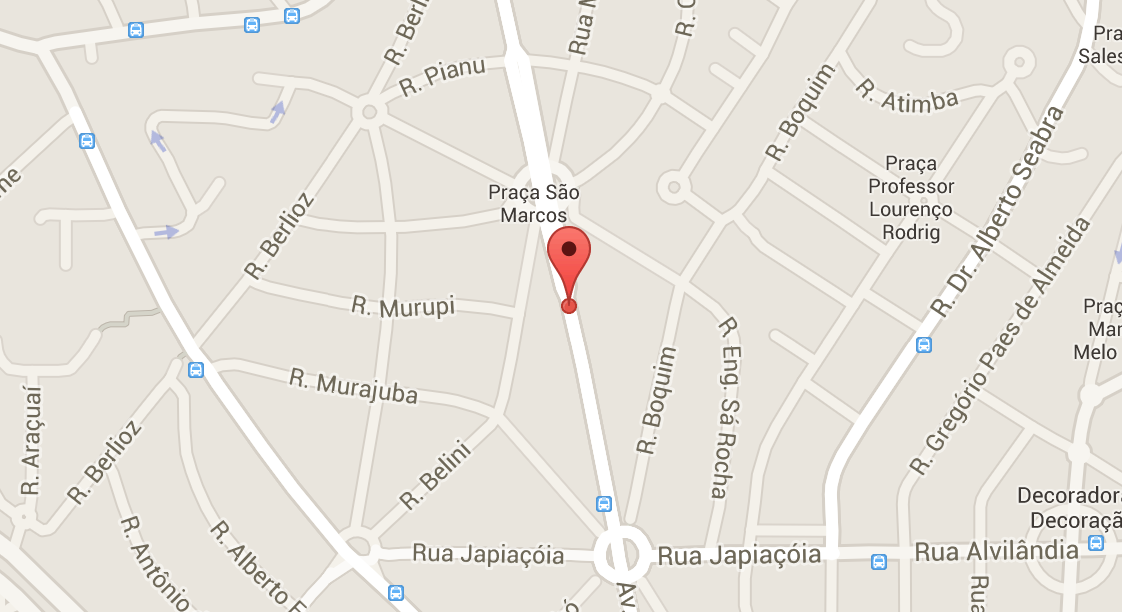

DANIEL B. CARNEIRO DA CUNHA

DANIEL B. CARNEIRO DA CUNHAPartner, Brazil

For the past 10 years Daniel has been a partner at DealMaker, a São-Paulo based boutique M&A and Management advisory firm with offices in Rio de Janeiro and Curitiba. At DealMaker Daniel was involved in activities such as strategic reviews, turn-around challenges, mergers and acquisitions and public offerings (IPO's), for Brazilian and international clients across several industries, with a particular focus on Services, Technology, Media & Telecom.

Between 2009-10, Daniel acted as CEO at Softcorp, a leading IT Systems Integrator controlled by the leading Brazilian venture capital firm IdeiasNet, where he led the company's strategic realignment, and is now a Board Member. Earlier in his career, Daniel held management positions at Brasil Telecom and .com Dominio Data Centers where he was involved primarily in new business development & acquisitions, including Internet related businesses. Daniel is also currently a Board Member and shareholder at ISPM, the leading provider of Service Level Management solutions for telecommunications networks in Brazil.